Dashboard | How BLAZE Calculates Taxes

This article breaks down how BLAZE calculates taxes on your sales

BLAZE calculates taxes per each product line item on an invoice, rather than calculating a percentage from the entire order total. The system will round each tax calculation to the nearest penny and then add them together to provide a tax total for your order.

In BLAZE, taxes are set on a product by product basis. Therefore different products can have different tax groups applied to them. This is why the system will calculate taxes per-line item. This can result in minor rounding discrepancies (explained below) but is an accepted way of calculating taxes by many POS systems.

Example:

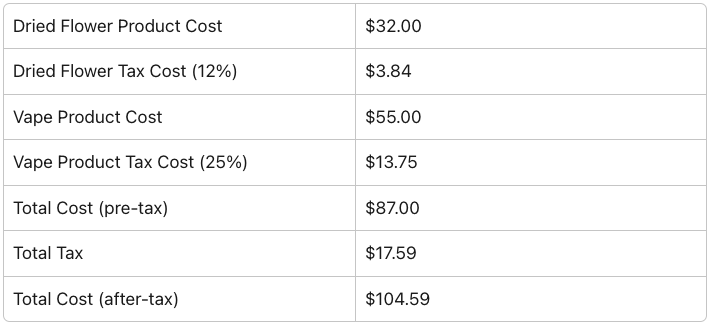

In British Columbia you could sell dried flower and a vape product in the same cart.

-

The dried flower product would have (5% GST + 7% PST for a total of 12% tax)

-

The vape product would have (5% GST + 20% Vape PST for a total of 25% tax)

FAQ

Why aren't my total taxes matching my exact tax group percentage?

The most common reason that this occurs is:

-

Products were sold without an associated tax group

-

Your calculations were made on the net sales total as opposed to each product line item

Example:

-

You sell 5 items at $28.39 before tax at 12% tax

-

Your tax per item will be $28.39 x 12% = $3.4068 (rounded to $3.41)

-

Your total tax will be $3.41 x 5 = $17.05

-

Order total would be:

-

Pre-tax cost: $28.39 x 5 = $141.95

-

Tax: $3.41 x 5 = $17.05

-

Order total = $159.00

-

If the tax calculations were based on the net sales order total instead of per-line you will get a slightly different result:

-

Order total would be:

-

Pre-tax cost: $28.39 x 5 = $141.95

-

Tax: $141.95 x 12% = 17.034 (rounded to 17.03)

-

Order total = $158.98 (off by 2 cents)

-