Dashboard | Understanding Last Cost and Weighted Average inventory cost calculations

Inventory cost calculations play a key role in helping businesses maintain accurate profit margins. BLAZE offers two options to calculate inventory wholesale costs: Last Cost and Weighted Average.

To view, or change, your Inventory cost calculation settings navigate to Settings > Inventory in your Greenline dashboard. The default setting is Last Cost.

*Please note: Changing your Inventory cost calculation setting will only affect reporting values starting from the day the setting was changed moving forward. Changing this setting does not affect reporting values for days before the setting was changed.

If you do not see the Settings option in your dashboard menu, this means that you do not have access to this section of the Greenline dashboard. Please contact your dashboard administrator if you require access to the dashboard Settings. Greenline support cannot change employee security roles or permissions.

BLAZE uses the cost per unit value entered into your purchase orders, or a manually entered product wholesale cost, to calculate profit margins.

Completing a purchase order will automatically set your product wholesale costs to be the same as the cost per unit entered into the completed purchase order.

*Please note: BLAZE does not support wholesale costs based on case price. Please enter the cost per unit into your purchase orders even if you purchased one or more cases of a product.

Last Cost

Last Cost represents the last, or most recent, wholesale unit cost you paid for any specific product. Last cost always uses this most recent wholesale cost to calculate your profit margins. Last cost does not take into account any changes, or fluctuations, to your wholesale costs.

Example:

In January, you order a product with a cost per unit of $10.00. When you complete the new purchase order, the cost per unit will automatically be set to $10.00. As you sell the product, your profit margin will be calculated using a cost per unit of $10.00.

In March, you reorder the same product but this time the cost per unit is $9.50. When you complete the new purchase order, the cost per unit will automatically be set to $9.50, regardless of any units remaining that were purchased for $10.00.

From this point forward your profit margin will be calculated using a cost per unit of $9.50.

To manually enter a wholesale cost for a specific product, click into the product from your dashboard Product List and navigate to the Pricing section of the product. Enter the new cost per unit and save the product to apply your changes.

*Please note: Editing wholesale costs will not affect historical margins.

Weighted Average

Weighted Average represents the average of all the costs per unit paid for a specific product, and the existing quantities of units purchased at a different cost per unit left in inventory. This pricing strategy accounts for changes in costs per unit over time, which can help retailers generate reports that reflect more accurate profit margins versus the last cost setting.

Example:

You order 10 units of a product at a cost per unit of $10.00. When you complete the new purchase order, the cost per unit will automatically be set to $10.00. This means that the total value of your current product inventory is $100 (10 units x $10). All sales from this point on have a cost per unit of $10.00.

During the month, you sell 6 units of the product and have 4 units remaining in inventory.

You reorder another 10 units of this product but this time the cost per unit is $9.50. The value of your newly received product inventory is $95.00 (10 units x $9.50).

Your total inventory quantity after completing the newest purchase order is now 14 units (4 units + 10 units).

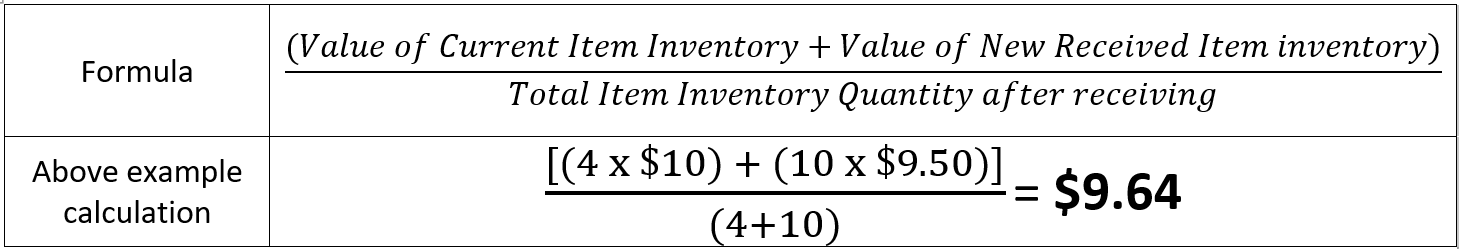

The weighted average setting then automatically calculates and adjusts the cost per unit value of the product using this formula:

Using the formula above, the cost per unit is now $9.64. From this point forward your profit margin will be calculated using a cost per unit of $9.64. As a result, retailers have a much more accurate cost calculation that takes into account any remaining inventory that was purchased at a different cost per unit.

The weighted average setting can be harder to understand but results in a more accurate profit margin calculation.

To manually enter a wholesale cost for a specific product, click into the product from your dashboard Product List and navigate to the Pricing section of the product.

When clicking into the Wholesale cost field, you will be prompted with the message shown below:

Click I understand to override the current weighted average cost calculation. Enter the new cost per unit and save the product to apply your changes.