Dashboard | Tax Configurations (V2 Tax Engine) BETA

Configure your taxes precisely by location and category using the highly flexible V2 Tax Engine

Setting up your Tax Configurations

1. Go to Settings > Tax Configuration in the Greenline dashboard.

2. Click Add Tax at the top right side of the page.

3. Fill out the appropriate fields in the Create New Tax Configuration page.

4. Click Save in the top right corner of the page.

New Tax Configuration Fields

When setting up a tax configuration, you'll see several new fields.

Let's go over what they all mean.

- Name: for internal use and must be unique - this will appear on reports.

- Display Name: this will appear on the POS cart and customer receipts and should accurately represent and clearly communicate the specific tax that is charged.

- e.g. PST (Cannabis 7%), PST (Vapor Products 20%), GST (5%), etc.

- Rate Type: how the tax amount is calculated, currently locked to percentage (%)

- Rate Amount: the tax value that is calculated and charged for a specific configuration.

- Categories: set taxes to all categories or a subset of categories and/or subcategories. Any products that exist within the selected category or subcategory will have taxes applied. If a parent category is selected, all subcategories within that parent category will have this tax configuration applied.

- Locations: specify the location(s) where the tax configuration applies. If no location is selected, the tax configuration will apply to all locations.

- Tax-Exempt Customer Types: specify the "Identity Type" set to customer profiles that enables automatic tax exemption for eligible customers. Only customers with these identity type selections will be exempted from the configured tax.

- Tax Type: specifies the type of tax, such as City, County, State, Federal, Excise, or Municipal. This may be left blank.

- Compounding Taxes: in the drop-down, select the existing tax configuration that will apply first at checkout. The tax being configured will then calculate on top of (after) that first tax.

- Taxable Fees: Retailers can now specify whether taxes apply to specific system fees like Shipping, Surcharge, Tips, and Bottle Deposits.

- Active: enables or disables the given tax configuration. If disabled, taxes will default to V1 tax settings (Settings > Taxes).

Tax Exempt Customer Profiles must have the "Tax Exempt" checkbox checked to ensure the correct taxes and/or exemptions are applied, depending on location specific configurations.

Flat, Stackable, Compounding Taxes Explained

Flat Tax

Stackable Tax

Compounding Tax

- GST at a rate of 5%

- PST at a rate of 20% (or the required provincial rate)

- Vaping devices (e.g. vaporizers and vape pens)

- Cartridges, parts and accessories for these devices

- Vaping substances (e.g. cannabis e-juice)

Example of an item priced at $10:

$10 + 20%(PST) = $12

$12 + 5%(GST) = $12.60

This ensures that the appropriate amount of tax is applied to the final purchase price of the vape product.

An Example of BC Vape Tax Setup:

- Create a tax configuration called BC Vape PST (20%)

- Apply it to vape categories

- Compounding = NO

- Create a tax configuration called GST (5%)

- Apply it to vape categories

- Compounding = YES, select the BC Vape PST (20%) tax

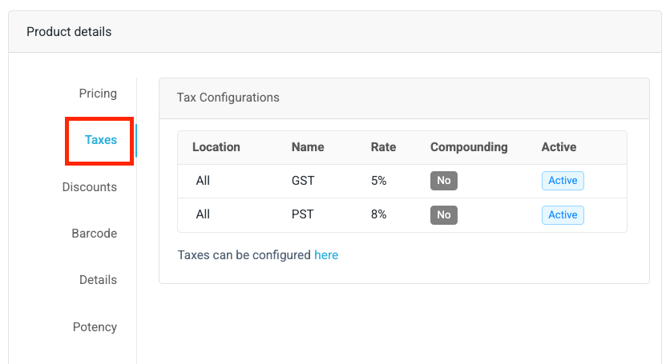

Viewing Tax Configurations Set to Products

Once tax configurations are set and active on the dashboard, they will automatically apply to the products in the appropriate categories.

Under the Product Details > Taxes, you will see the tax configurations associated with the product: