Dashboard | Dashboard Settings

This article provides a breakdown of all the dashboard settings. Here you can customize your locations, POS devices, receipts, tax groups, inventory auditing, and set up gift cards.

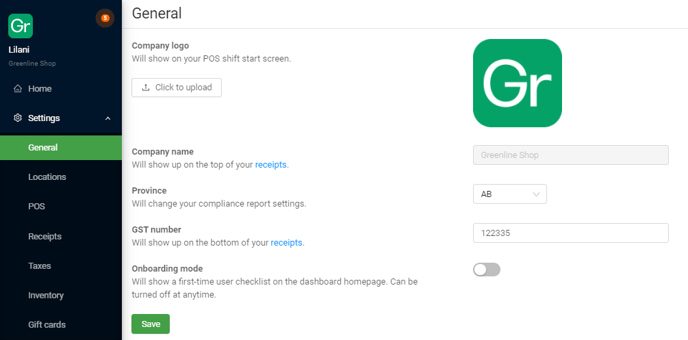

Settings - General

Company logo: Upload your logo which will show on your POS device(s) when you start a shift. This is completely optional, but many stores enjoy branding their systems.

Company name: Will show at the top of your sales receipts.

Province: Will determine which compliance report is generated, and which provincial product database you have access to. This is very important because compliance reports are generated differently for every province.

GST number: This Will show up at the bottom of your receipts. This ensures that the sale was legally tendered.

Onboarding mode: First-time users have this setting enabled. Disabling it will change what information is displayed on your Dashboard homepage.

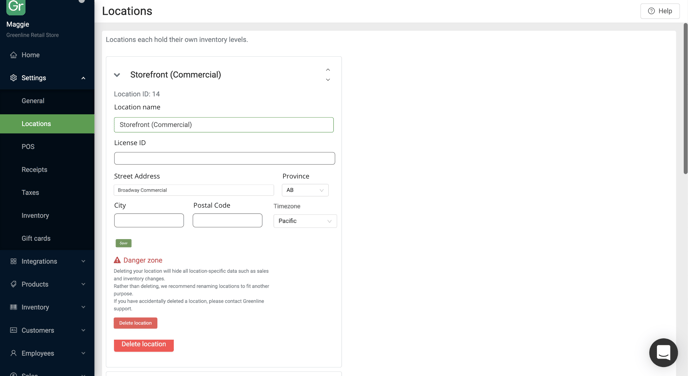

Settings - Locations

Locations represent unique inventory storage locations in BLAZE. These can be physical and/or virtual locations.

If you expand each location, you can enter:

-

Location Name

-

License ID

-

Street Address

-

Province

-

City

-

Postal Code

-

Time zone

When you set up a store, you have 2 options. If you are creating a new location or storefront, please contact our Sales team at sales-ca@blaze.me for billing purposes.

-

(Most common) 1 inventory location for 1 store. This keeps your inventory management very simple and easy to train for.

-

(Less common) 2 inventory locations for 1 store. This allows you to have a front/back separation, but due to the overhead of adding transfers whenever inventory moves back and forth, this is only suitable for large stores with lots of inventory management staff.

When you delete a location, it will prevent any associated data (sales, inventory, etc.) from being accessed. Please contact Customer Support to assist prior to deleting locations.

Settings - POS

The POS section displays all the POS devices that are attached to your account by location. Typically, each of your cash registers or till stations will be assigned to a specific iPad device. Each iPad needs to be assigned to a POS device ID and has a unique password. You can change the password for each of the devices and set up payment integrations.

POS devices can only be added by the BLAZE support staff. If you need additional devices, please contact us via live chat or at support-ca@blaze.me.

-2.png?width=624&height=449&name=image%20(2)-2.png)

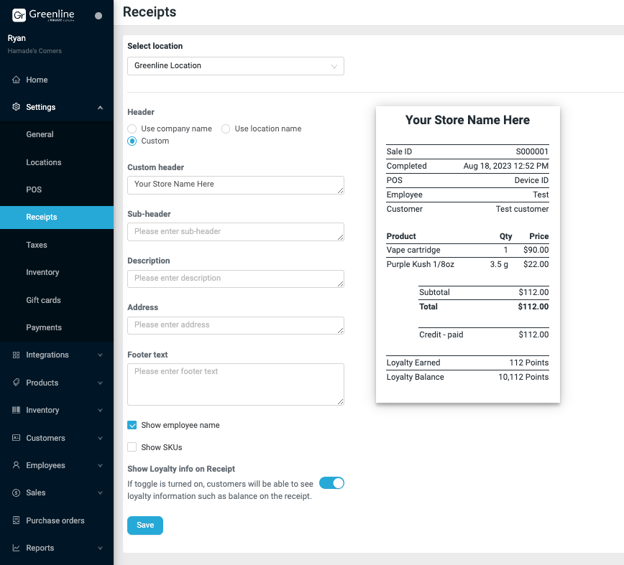

Settings - Receipts

This section provides a preview of your store's sales receipts. Here you may customize your receipt headers, footers, description, etc.

"Use company name" is the default selection for receipt headers. Particularly useful for single location dashboards. An example of the company name is found beneath the employee name in the top left corner of the dashboard.

"Use location name" will set the receipt header to display the name input to the location card under Settings > Locations. This will be helpful for multi-location dashboards.

"Custom" will allow for any input, regardless of company or location names set to the dashboard.

In the footer, you can include information such as refund or return policies. You can also include the employee name and/or SKU numbers on the receipt by selecting either of the check boxes.

Stores using Greenline's Loyalty program may display a customer's balance by toggling "Show loyalty info on Receipt"

Settings - Taxes

Tax groups consist of multiple taxes. They should be pre-created as part of your account setup, but please double-check them before you start adding products.

Taxes are applied on a per-product basis, so it's important to make sure all taxable products are attached to the right group.

BC Vape Tax

The BC vape tax (20%) works slightly differently from all the other taxes in that it is applied first BEFORE any other taxes are applied. So while 20% + 5% is 25%, in reality the total tax will be (retail price * vape tax) * GST. For more information, please visit the BC government's page on vape taxes.

-2.png?width=624&height=249&name=image%20(4)-2.png)

SK Vape Tax

A Vapour Products Tax (VPT) of 20 % is effective as of September 1, 2021. The VPT will apply to retail sales of all vapour products in Saskatchewan pursuant to The Vapour Products Tax Act. Provincial Sales Tax (PST) at the rate of 6% will continue to apply to all cannabis products and accessories sold through August 31, 2021, after which it will be replaced on vapour products only by the VPT. Products subject to VPT will not be subject to PST.

While the VPT generally does not apply to cannabis products, there are a number of goods sold by many cannabis retailers that will be subject to the tax.

"Vapour product" means any or all of the following:

-

an e-cigarette, meaning a product or device, whether or not it resembles a cigarette, containing an electronic or battery-powered heating element capable of vaporizing an e-substance for inhalation or release into the air (or similar product or device), and includes a product or device that is capable of vaporizing cannabis for inhalation or release into the air;

-

an e-substance, meaning a solid, liquid, or gas that, on being heated, produces vapour for use in an e-cigarette, regardless of whether it contains nicotine;

-

a cartridge for or a component of an e-cigarette;

but does not include:

-

cannabis as defined in The Cannabis Control (Saskatchewan) Act; or

-

heated tobacco product as defined in The Tobacco Tax Act, 1998; or

-

a dry herb vaporizer intended for use with dried cannabis within the meaning of The Cannabis Control (Saskatchewan) Act.

Any retailers selling goods subject to the VPT are required to be registered with the Ministry of Finance as a VPT Licensed Vendor for the purpose of collecting and remitting VPT at 20% on taxable sales. This license is in addition to the PST Vendor's Licence required for PST taxable sales. A separate return must be completed to report and remit the VPT collected. The Application for Registration is available at www.sets.saskatchewan.ca.

For more information, please refer to Information Bulletin VPT-1, Vapour Products Tax and direct any questions to SaskTaxInfo@gov.sk.ca. In addition, Information Bulletin PST-74, Information for Vendors of Cannabis, has been updated (revisions noted by a bar (|) in the left margin) to include information about VPT obligations.

Settings - Inventory

Audit counting mode - Regular: When doing audits under Dashboard > Inventory > Audits, the user will see the expected quantities per product.

Audit counting mode - Blind: When doing audits under Dashboard > Inventory > Audits, the user will not see expected quantities per product.

Audit completing mode - Relative: When you count inventory, the difference will be applied against your inventory from when you started the audit. This is good for stores that perform inventory counts during customer business hours.

Audit completing mode - Replace: When you count inventory, the final count will be applied against your inventory from when you started the audit. This is good for stores that want to keep counting simple and outside of customer business hours.

Inventory cost calculation: BLAZE provides 2 ways of tracking costs for your products: "weighted average" and "last cost". For more information, please visit this article.

Parked sale barcode validation: Adds an additional level of inventory selection accuracy for pending/online sales orders.

Block negative inventory sales: When a sale is made that would result in negative inventory quantities, a warning will appear on the POS system prior to processing the sale. A manager will be required to override the sale into a negative inventory quantity.

Automatic restock for refunded cannabis products: When enabled, refunded cannabis products will automatically be restocked in the inventory. For more information, review the article Altering Sales under the FAQs section.

Settings - Gift cards

BLAZE supports integrated gift cards from Merrco and Birchmount. You can learn more in this article.

-1.png?width=688&height=247&name=image%20(6)-1.png)

-4.png?width=688&height=514&name=image%20(5)-4.png)